stock option tax calculator ireland

Stock options There are a number of issues with the current taxation of stock options. On the date of exercise the fair market value of the stock was 25 per share which is.

What Is Bitcoin Cash Civic Cryptocurrency Currency Converter Iphone Apps Free Bitcoin

The problem is that there is literally no information in the Internet about how this activity would be taxed in.

. Poor Mans Covered Call calculator addedPMCC Calculator. These shares are a benefit in kind BIK. The first 1270 of gains made by any individual in a tax year are exempt from Capital Gains Tax and so the.

Exercising stock options and taxes. See example below on how to calculate share profit. How to calculate the tax on share options.

You paid 10 per share the exercise price which is reported in box 3 of Form 3921. Hi everyone Im interested in starting to trade US stock options contracts. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

This places Ireland on the 8th place in the International Labour. Your payroll taxes on gains from. Example of Reduced Capital Gains Tax on Shares in Ireland.

Using the ESPP Tax and Return Calculator. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Your payroll taxes on gains from. Find the best spreads and short options Our Option Finder tool. Stock options There are a number of issues with the current taxation of stock options.

342 Short Options - Tax at Date of Grant Where a share option is not capable of being exercised more than seven years after the date on which it is granted ie. If you sold all 500 shares then your total gain would be 2500. A short option no charge to.

The Stock Calculator is very simple to use. Enter the purchase price per share the selling price per share. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

Lets say you got a grant price of 20 per share but when you exercise your. Annual Income Tax Calculator 2022 Salary. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market.

4 HI hospital insurance or Medicare is 145 on all earned income. The wage base is 142800 in 2021 and 147000 in 2022. The Global Tax Guide explains the taxation of equity awards in 43 countries.

Assuming the 40 tax rate applies the tax on. Let us introduce Emily who exercised her. Just follow the 5 easy steps below.

In October 2022 they are worth 800 each. Enter the number of shares purchased. Stock options restricted stock restricted stock units performance shares stock appreciation rights and.

The relevant tax on share options is paid at 52. An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. You purchase 10 Irish shares in January 2022 at a cost of 500 each.

Cash Secured Put calculator addedCSP Calculator. Exercising your non-qualified stock options triggers a tax. This paper profit is immediately liable for income tax and must be paid over to the Revenue within 30 days of exercising the option.

Companies Irish branches and agencies granting options including an Irish employer where the options are granted by a non resident parent company must complete. The gain will be subject to Capital Gains Tax when you. When you exercise a qualifying share option under the KEEP programme any gain will not be subject to income tax PRSI or USC.

Marginal tax rates currently up to 52 apply on the exercise of share options. Taxes for Non-Qualified Stock Options. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month.

A share option is the right to buy a certain number of shares at a fixed price sometime in the future within a company.

Debt Arrangement Scheme Scottish Das Mortgage Repayment Calculator Debt Problem Repayment

Discover Your Potential Recruitment Startup Company Funding Options Visit Http Wearessg Com Setting Up A Recruitment Business

Mortgage Calculator Estimate Your Monthly Payments

How To Calculate Net Operating Loss A Step By Step Guide

Isos Tax Return Tips And Traps Mystockoptions Com

Investment Calculator Financial Planning Calculator Online

Mortgage Calculator Estimate Your Monthly Payments

Option Price Calculator American Or European Options

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Isos Tax Return Tips And Traps Mystockoptions Com

Isos Tax Return Tips And Traps Mystockoptions Com

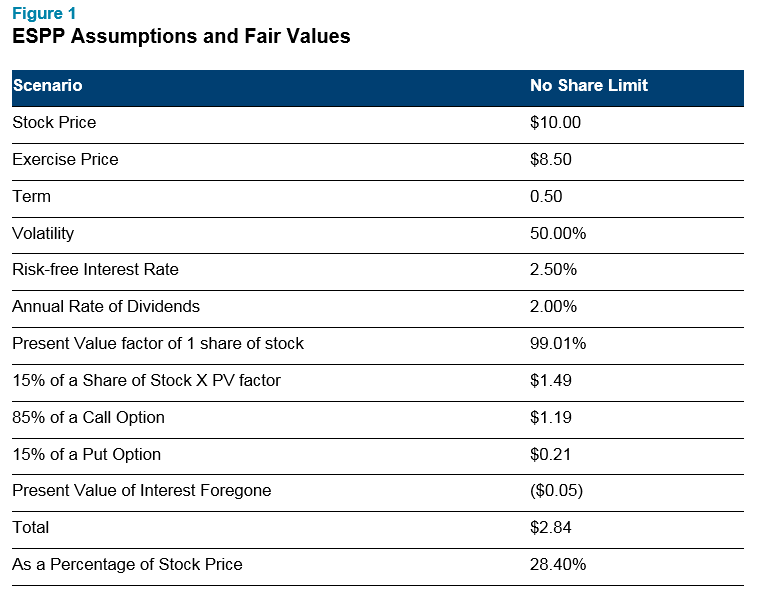

Determining The Fair Value Of Your Espp

Commercial Property Lease Agreement How To Create A Commercial Property Lease Agreemen Lease Agreement Free Printable Lease Agreement Travel Planner Template

Calculate Import Duties Taxes To Canada Easyship

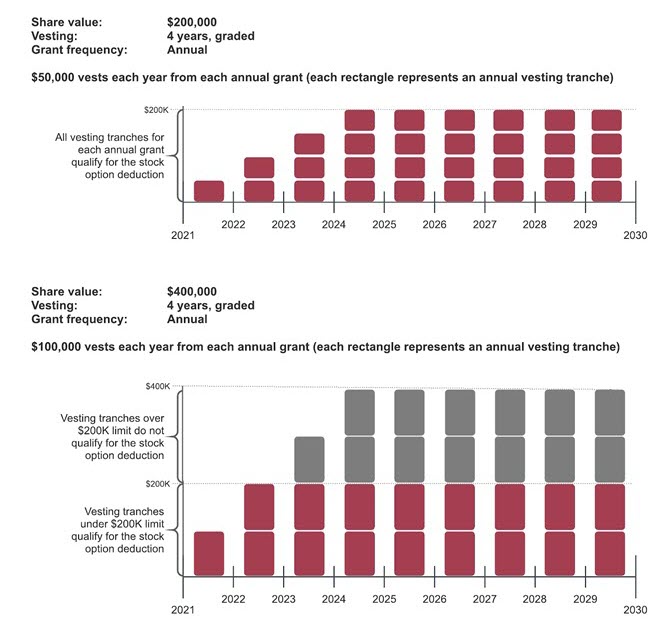

Tax Insights New Rules On The Taxation Of Employee Stock Options Will Be Effective July 1 2021 Pwc Canada

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

I Wish To Love And Protect Our Future A Good Retirement Savings Plan Is Very Important Loveandprotec Mortgage Payoff Pay Off Mortgage Early Mortgage Loans

Travel Checklist Templates 13 Free Docs Xlsx Pdf Checklist Template Checklist Templates